If you are applying for a UK Partner Visa from outside the UK then Appendix 2 of the VAF4A form must be completed.

The form requires the applicant to provide information on their relationship with their UK partner, accommodation and the UK partners financial details.

There are 5 parts to the form and it is 18 pages long.

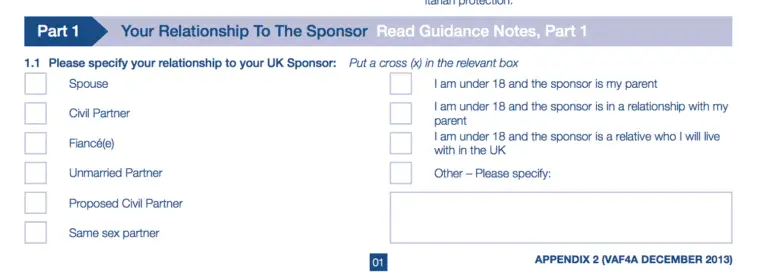

Part 1: Your Relationship To The Sponsor

Part 1 is where the applicant should provide details about their Sponsor. The Sponsor will be the applicant’s UK partner.

In Part 1, the applicant will be asked questions about how they met the sponsor and how often they see them.

Part 1 includes questions such as

- “Are you married/in a civil partnership with your sponsor?”

- “When did your relationship start?”.

Part 2: Your Accommodation & Other Details

Part 2 is where the applicant will be required to provide details of the accommodation where they will be living with their UK partner.

The applicant must include details of the number of bedrooms and reception rooms along with the details of everyone who will be living at the property.

This is to ensure that the applicant will be living in adequate accommodation and there is no overcrowding.

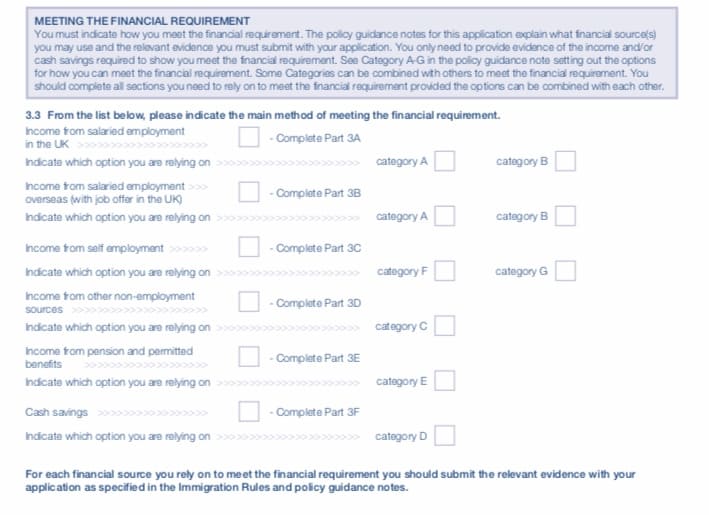

Part 3: Financial Requirement

Part 3 is where the applicant must provide details of how their sponsor meets the financial requirement of their visa application under Appendix FM.

This part of the form is where most people applying for a visa struggle.

First, you must select how the sponsor meets the financial requirements.

Then you must select under which category.

There are 5 categories which can be used to meet the financial requirement.

Some categories can be combined with others to meet the financial requirement.

Providing the options can be combined together, the applicant should complete all sections they will be relying on to meet the financial requirement.

Category A

This is employment income if you have worked in the same job for 6 months or more.

Category B

This is employment income if you haven’t worked in the same job for more than 6 months.

Category C

The applicant should choose this category if they will be relying on non-employment income to meet the financial requirement.

Category D

This is cash savings.

Category E

The applicant will select this category if they meet the financial requirement through pension income.

Category F

This is self-employment income from the last full financial year.

Category G

This is self-employment income from the last 2 full financial years.

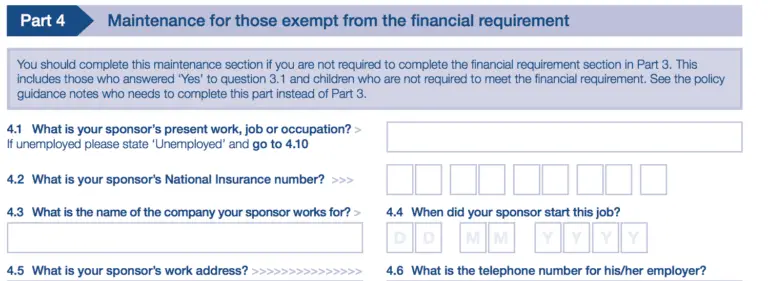

Part 4: Maintenance for those exempt from meeting the financial requirement

The applicant will only have to complete Part 4 if their UK partner is in receipt of a permitted benefit and is not required to meet the financial requirement.

Part 5: Continuation and Additional Information

The applicant should use this section to provide the Home Office with any other relevant information that they have not been able to provide elsewhere in this form.

If there is nothing more to add this section can be left blank.

Appendix 2 of VAF4A form can be downloaded from the GOV.UK website by clicking here.

Step by Step Guide

You do not have to complete every question on the form.

How you meet the financial requirement will determine which parts of the form you must complete.

If you are unsure about how to answer a particular question read the guidance notes at the end of the form.

This part of the form should only be completed if the company that employs the UK partner is NOT owned by the UK Partner, the applicant or a family member.

The application generally includes the following sections:

- Part 1

- Part 2

- Part 3.1-3.3

- Part 3A or Part 3B

- Part 5

If you meet the financial requirement through the UK partner’s 6 months of employment then this would be Category ‘A’.

If you meet the financial requirement through the UK partner’s 12 months employment then this would be Category ‘B’.

The application generally includes the following sections:

- Part 1

- Part 2

- Part 3.1-3.3

- Part 3C

- Part 5

If self-employment income from the last full financial year is used, you should select Category F.

If self-employment income from the last 2 full financial years will be used, you should select Category G.

The application generally includes the following sections:

- Part 1

- Part 2

- Part 3.1-3.3

- Part 3D

- Part 5

The application generally includes the following sections:

- Part 1

- Part 2

- Part 3.1-3.3

- Part 3E

- Part 5

The application generally includes the following sections:

- Part 1

- Part 2

- Part 3.1-3.3

- Part 3F

- Part 5

The application generally includes the following sections:

- Part 1

- Part 2

- Part 3.1

- Part 4

- Part 5

If you have the correct documents in place for your visa application completing appendix 2 of VAF4A becomes much simpler.